2015-Q4 Results released on website

PARADISE GAS CARRIERS CORP

Quarterly Management report

Date : 31/12/2015

Quarterly results

(in USD thous.)

| BALANCE SHEET

(end of period) |

31/12/2014

(audited) |

31/3/2015

(unaudited) |

30/6/2015

(unaudited) |

30/9/2015

(unaudited) |

31/12/2015

(unaudited) |

|

|

|

| Cash & cash equivalents |

5,941 |

12,775 |

12,160 |

13,801 |

15,509 |

|

|

|

| Other Current Assets |

6,754 |

7,018 |

6,726 |

7,820 |

7,694 |

|

|

|

| Total Current Assets |

12,695 |

19,793 |

18,886 |

21,621 |

23,203 |

|

|

|

| Fixed Assets, net |

87,015 |

85,707 |

68,682 |

67,528 |

66,031 |

|

|

|

| Vessels under construction |

4,811 |

9,540 |

9,540 |

20,631 |

23,776 |

|

|

|

| Deferred drydocking costs |

1,240 |

3,442 |

3,476 |

3,505 |

4,709 |

|

|

|

| Other Non-Current Assets |

627 |

695 |

4,415 |

4,378 |

3,800 |

|

|

|

| Total Assets |

106,388 |

119,177 |

104,999 |

117,663 |

121,519 |

|

|

|

| Current portion of LT debt |

5,249 |

6,322 |

5,630 |

6,530 |

5,880 |

|

|

|

| Shareholders’ loans |

14,653 |

14,653 |

0 |

0 |

0 |

|

|

|

| Other current liabilities |

4,150 |

5,192 |

4,024 |

4,728 |

5,708 |

|

|

|

| Total Current Liabilities |

24,052 |

26,167 |

9,654 |

11,258 |

11,588 |

|

|

|

| Long-term debt |

20,436 |

29,181 |

22,965 |

31,433 |

30,025 |

|

|

|

| Other non-current liabilities |

0 |

0 |

1,800 |

1,800 |

1,800 |

|

|

|

| Total Liabilities |

44,488 |

55,348 |

34,419 |

44,491 |

43,413 |

|

|

|

| Paid-in capital |

61,500 |

62,850 |

65,970 |

66,000 |

68,750 |

|

|

|

| Retained Earnings |

400 |

979 |

4,610 |

7,172 |

9,356 |

|

|

|

| Shareholders Equity

(Book NAV) |

61,900 |

63,829 |

70,580 |

73,172 |

78,106 |

|

|

|

|

|

|

|

|

|

|

|

| INCOME STATEMENT |

31/12/2014 (audited) |

2015/Q1 (unaudited) |

2015/Q2 (unaudited) |

2015/Q3 (unaudited) |

2015/Q4 (unaudited) |

|

31/3/2015

(YTD results) |

30/6/2015

(YTD results) |

30/9/2015

(YTD results) |

31/12/2015

(YTD results) |

|

|

|

|

|

|

|

|

|

|

|

| Operating Revenue |

22,745 |

9,067 |

8,790 |

11,526 |

10,648 |

|

9,067 |

17,857 |

29,383 |

40,031 |

| Less: Voyage Expenses |

(5,469) |

(691) |

(131) |

(86) |

(289) |

|

(691) |

(822) |

(908) |

(1,197) |

| Less: Commissions & Chartering Fees |

(845) |

(154) |

(119) |

(147) |

(157) |

|

(154) |

(273) |

(420) |

(577) |

| TCE Earnings

(net) |

16,431 |

8,222 |

8,540 |

11,293 |

10,202 |

|

8,222 |

16,762 |

28,055 |

38,257 |

| Operating expenses

(excl. man fees) |

(9,247) |

(3,964) |

(3,728) |

(4,058) |

(4,177) |

|

(3,964) |

(7,692) |

(11,750) |

(15,927) |

| Management Fees

(related parties) |

(743) |

(322) |

(325) |

(328) |

(329) |

|

(322) |

(647) |

(975) |

(1,304) |

| Charter hire expenses |

– |

– |

(342) |

(1,128) |

(1,039) |

|

– |

(342) |

(1,470) |

(2,509) |

| G+A Expenses |

(377) |

(65) |

(34) |

(75) |

(141) |

|

(65) |

(99) |

(174) |

(315) |

| EBITDA |

6,064 |

3,871 |

4,111 |

5,704 |

4,516 |

|

3,871 |

7,982 |

13,686 |

18,202 |

| Depreciation |

(3,491) |

(1,341) |

(1,277) |

(1,153) |

(1,497) |

|

(1,341) |

(2,618) |

(3,771) |

(5,268) |

| Amortisation |

(118) |

(179) |

(212) |

(253) |

(293) |

|

(179) |

(391) |

(644) |

(937) |

| Gain on Vessels’ disposal, net* |

– |

– |

2,715 |

(128) |

– |

|

– |

2,715 |

2,587 |

2,587 |

| EBIT |

2,455 |

2,351 |

5,337 |

4,170 |

2,726 |

|

2,351 |

7,688 |

11,858 |

14,584 |

| Interest & Finance Expences |

(553) |

(429) |

(379) |

(382) |

(367) |

|

(429) |

(808) |

(1,190) |

(1,557) |

| Other finance expenses |

(161) |

(122) |

(338) |

(110) |

(100) |

|

(122) |

(460) |

(570) |

(670) |

| Extraordinary & other expenses, net |

(278) |

(190) |

1 |

(126) |

(157) |

|

(190) |

(189) |

(315) |

(158) |

| Net Income |

1,463 |

1,610 |

4,621 |

3,552 |

2,416 |

|

1,610 |

6,231 |

9,783 |

12,199 |

Out of book adj.

(codification of borr cost) * |

41 |

27 |

294 |

286 |

110 |

|

27 |

321 |

607 |

717 |

| Net Income adjusted |

1,504 |

1,637 |

4,915 |

3,838 |

2,526 |

|

1,637 |

6,552 |

10,390 |

12,916 |

|

|

|

|

|

|

|

|

|

|

|

| Dividends distributed |

– |

990 |

990 |

990 |

990 |

|

990 |

1,980 |

2,970 |

3,960 |

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOW STATEMENT

(period) |

31/12/2014

(audited) |

31/3/2015

(unaudited) |

30/6/2015

(unaudited) |

30/9/2015

(unaudited) |

31/12/2015

(unaudited) |

|

|

|

|

| Cash from Operations |

4,626 |

1,568 |

442 |

4,766 |

9,767 |

|

|

|

|

| Cash from Investing |

(57,276) |

(4,803) |

15,228 |

4,137 |

1,142 |

*PGC IKAROS was sold and leased back |

| Cash from Financing |

52,138 |

10,070 |

(9,451) |

(1,043) |

(1,341) |

|

|

|

|

| Change of cash in periods |

(512) |

6,835 |

6,219 |

7,860 |

9,568 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FY14 |

2015q1 |

2015q2 |

2015q3 |

2015q4 |

|

|

|

|

| Loan repayments

(net**) |

(1,065) |

(1,183) |

(1,356) |

(1,633) |

(2,058) |

**Net of refinancing proceeds/prepayments |

|

|

|

|

|

|

|

|

|

|

| STATISTICS

(during quarter) |

12m2014 |

2015/Q1 |

2015/Q2 |

2015/Q3 |

2015/Q4 |

|

|

|

|

| Average # of Ships Owned during Period |

3.7 |

6.0 |

6.0 |

6.0 |

6.0 |

|

|

|

|

| Average Age of Fleet at end of Period |

12.4 |

12.7 |

12.9 |

13.2 |

13.4 |

|

|

|

|

| ShipYears Left |

63.5 |

62.0 |

60.6 |

59.0 |

57.5 |

Assumed 26 yrs for LPG’s and 20 for Tankers |

| Fleet Valuation ($mill) – end period |

104.2 |

107.3 |

89.7 |

100.8 |

104.2 |

VesselsValue.com

(PGC Ikaros has been sold) |

| Leverage |

24.6% |

33.1% |

31.9% |

37.7% |

34.5% |

excl. shareholders’ loans |

| Market NAV ($mill) (1) |

73.1 |

72.4 |

78.5 |

82.3 |

87.8 |

See note 1 below |

| Paid-in capital ($mill) |

61.5 |

62.85 |

66.6 |

66.0 |

68.8 |

|

|

|

|

| Enterprise Value (EV) |

107.48 |

109.80 |

94.98 |

106.50 |

108.21 |

EV = Market NAV plus debt (incl. SH loans) less cash |

| Book NAV per 100 usd invested ($) |

100.65 |

101.56 |

106.99 |

110.87 |

113.61 |

Book NAV divided by paid-in capital |

| Market NAV per 100 usd invested ($) |

118.83 |

115.22 |

119.06 |

124.75 |

127.73 |

Market NAV divided by paid-in capital |

| Dividends received per 100usd invested ($) |

0.00 |

1.58 |

3.07 |

4.57 |

6.01 |

cumulative dividends received for 100 usd invested |

| RoE (annualised)* |

2.4% |

10.4% |

29.3% |

21.4% |

13.4% |

*Net Income/Total equity (average of last period), includes capital gain |

| RoA (annualised)* |

1.4% |

5.8% |

17.5% |

13.8% |

8.4% |

*Net Income/Total Assets (average of last period), includes capital gain |

| EV/EBIT (annualised) * |

43.78 |

28.44 |

10.53 |

8.81 |

7.08 |

*EV (today) / EBIT (TTM) |

| P/E* |

49.95 |

32.99 |

11.36 |

8.63 |

6.83 |

*Market NAV/Net Earnings (TTM) |

| Dividend Yield * |

0.0% |

1.4% |

2.52% |

3.61% |

4.51% |

*Dividends distributed in the last 12m (TTM)/Market NAV |

| Average TCE per Ship, net* |

13,788 |

17,134 |

16,774 |

20,458 |

19,252 |

*Net of BB charter hires |

| Average Opex per Ship

($/pd), incl. man fees |

7,452 |

7,937 |

7,423 |

7,946 |

8,163 |

incl. management fees |

| Average charter hire expense per Ship ($/pd) |

0 |

0 |

627 |

2,043 |

1,882 |

BB charter-in hires |

| Average GA & other costs per Ship ($/pd) |

281 |

120 |

62 |

136 |

255 |

|

|

|

|

| Average debt-service per ship ($/pd) |

1,207 |

2,984 |

3,177 |

3,649 |

4,393 |

incl. debt-service, other finance costs as well as deferred finance charges |

| Cashflow TCE Breakeven per Ship |

8,911 |

11,042 |

11,289 |

13,774 |

14,694 |

|

|

|

|

| Cashflow Margin |

54.2% |

55.2% |

48.6% |

48.5% |

31.0% |

|

|

|

|

| Income Statement TCE Breakeven per Ship * |

11,134 |

12,194 |

12,612 |

13,273 |

13,905 |

*excl. capital gain |

| Ownership Days (average) |

365.00 |

90.00 |

91.00 |

92.00 |

92.00 |

|

|

|

|

| Available Days efficiency (2) |

88.9% |

88.9% |

93.2% |

100.0% |

96.0% |

See note 2 below |

| Operating Days efficiency (3) |

83.0% |

88.9% |

92.8% |

100.0% |

94.4% |

See note 3 below |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Market values are calculated as follows: In the event that the online VesselsValue platform (VV) shows higher values than our books (BV) we account 75% of that premium, otherwise we account for the full difference if VV is lower than BV. Fleet valuation includes also advances for NB orders.

(2) Available Days Efficiency is the ratio of the days that the fleet was available for revenue generating; divided to the Ownership days

(3) Operating Days Efficiency is the ratio of the days the ships were actually employed (TC or Spot) and generating revenues (after deducting the off-hire days); divided to the Ownership days

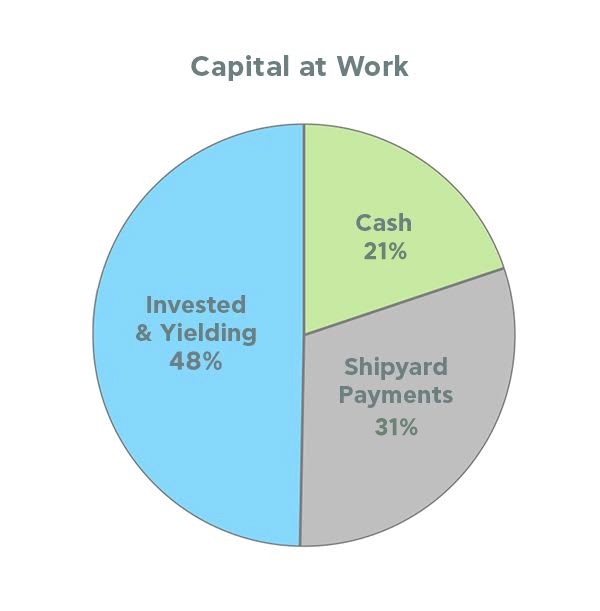

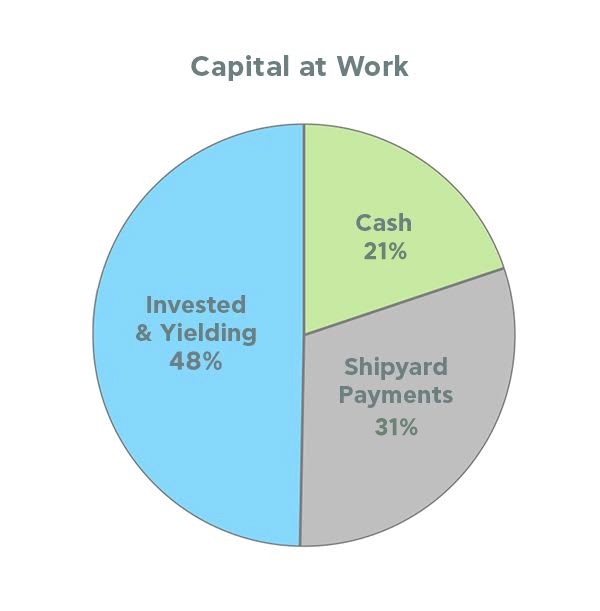

Capital at work

Net Asset Value of $100 Invested in PGC from the start

TCE vs cash / p&l b-even